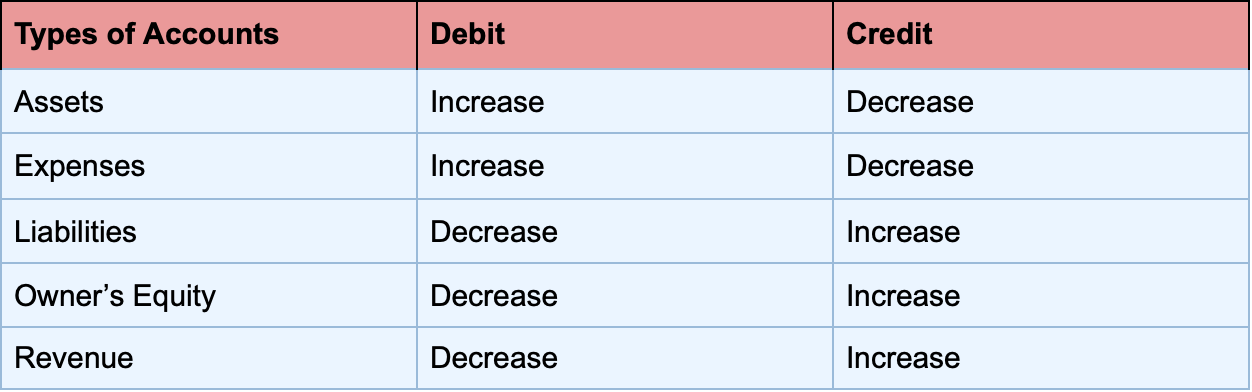

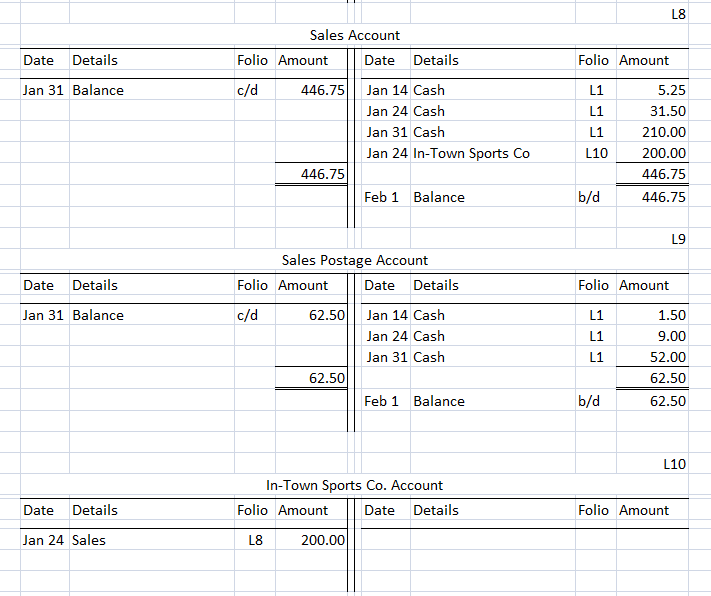

In such conditions, the double-entry accounting system is usually used to efficiently manage the accounts and make the whole auditing process smooth and easy. Double-entry is a crucial part of accounting that cross-checks the accuracy of all the transaction records for reliability. Its roots can be traced back as far as the 1490s.Īudit firms in Singapore often have to work with large corporations, businesses and enterprises where getting their entire business audited and getting a true image of finances can be quite tricky. It should be noted that the double-entry system is a very old and tried-and-tested method of accounting. This also provides accurate results at the end of the accounting process. Double-entry bookkeeping is the concept that every accounting transaction impacts a companys finances in two ways. Through this method, two entries are written for each transaction to ensure there are no errors in calculations. In simple words, the double-entry accounting system is a bookkeeping strategy that maintains an organization’s accounts balanced, showing an accurate picture of financial transactions. Keywords: balance of payments double-entry bookkeeping nations economic account reserve assets. Double-entry bookkeeping is a system of recording all the financial transactions that are completed by an individual or company. There is a bookkeeping equation: Assets Liabilities + Equity. There will be a debit entry for each credit entry, and both sides will be an equal amount. They decrease the assets and expense while increasing liability and income accounts. understanding Double entry bookkeeping is essential it comprises of debits and credits, which must be equal. The Double Entry bookkeeping system is based on the transaction’s debit and credit accounts.

Therefore, any transaction should involve at least two accounts. This guide will provide you with all you need to know about how it is used, and why it works as an accounting system. Actually, it has been used for more than 500 years, tracing it back to the merchants of Venice, and still remains relevant. They reduce the liability and earnings account.Ĭredits, however, have the complete opposite impact on accounts. Double Entry BookkeepingIn this course we will follow some simple steps which explains the concepts of double entry bookkeeping easily & quicklyRating: 3.8 out of 556 reviews1 total hour10 lecturesBeginnerCurrent price: 14.99Original price: 49.99. Double Entry bookkeeping is based on a basic principle that an equal but opposite credit must exist for every debit. The double-entry bookkeeping system is one of the standard systems used by small and large companies today. Debits increase asset and expense accounts. A double-entry accounting system means recording the transactions of a business in two distinct accounts:īoth of these accounts impact a business in different ways. Most businesses, even most small businesses, use double-entry bookkeeping for their accounting needs.

0 kommentar(er)

0 kommentar(er)